Hi Team,

Welcome to this week's edition of the Pristine Capital Weekend Watchlist! 👋

In this research note, we’ll cover the following topics in preparation for the upcoming trading week:

Sector relative strength analysis across multiple timeframes

Macro Analysis

Three A+ Trade Setups

And much more! Let's get started! 👇

If you’ve been enjoying our free content, and are committed to putting in the work to make 2025 your best trading year yet, consider upgrading your membership and becoming a premium subscriber.

ANNOUNCEMENT: Our Pristine Tradingview Indicators will be released for purchase this week! Stay tuned for early adopter pricing👇

Sector/Style Factor Relative Strength Analysis

A key part of our technical process is tracking momentum across style factors and sectors on multiple timeframes. Our goal is to follow the flow of capital and spot trend changes early

Style Factor YTD Performance

For the first time in a long time, the Momentum style factor is NOT leading. Low volatility stocks took the lead during the most recent corrective sequence in US Equities, but it is still a tight race! 👇

YTD Sector Performance

GDX Gold miners leading👇

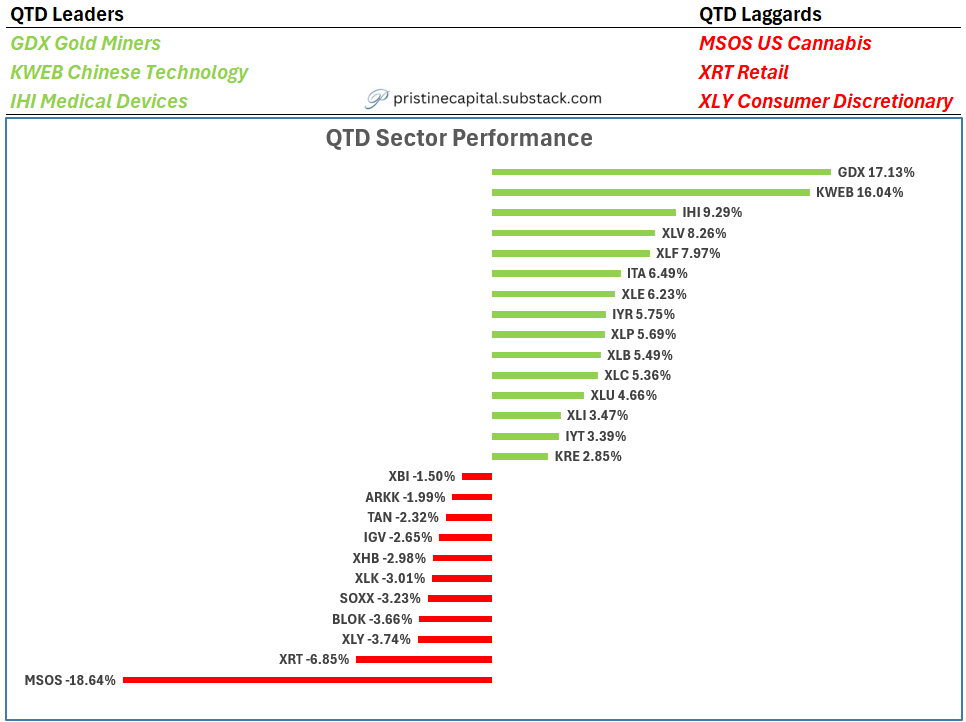

QTD Sector Performance

Identical to YTD given we are in Q1 👇

1-Month Sector Performance

KWEB China & XLP consumer staples outperformed

High beta groups sold off👇

1-Week Sector Performance

KWEB China finally pulled back

ITA Aerospace & defense led 👇

Keep reading with a 7-day free trial

Subscribe to Pristine Capital to keep reading this post and get 7 days of free access to the full post archives.